Market Commentary

Q4 2025

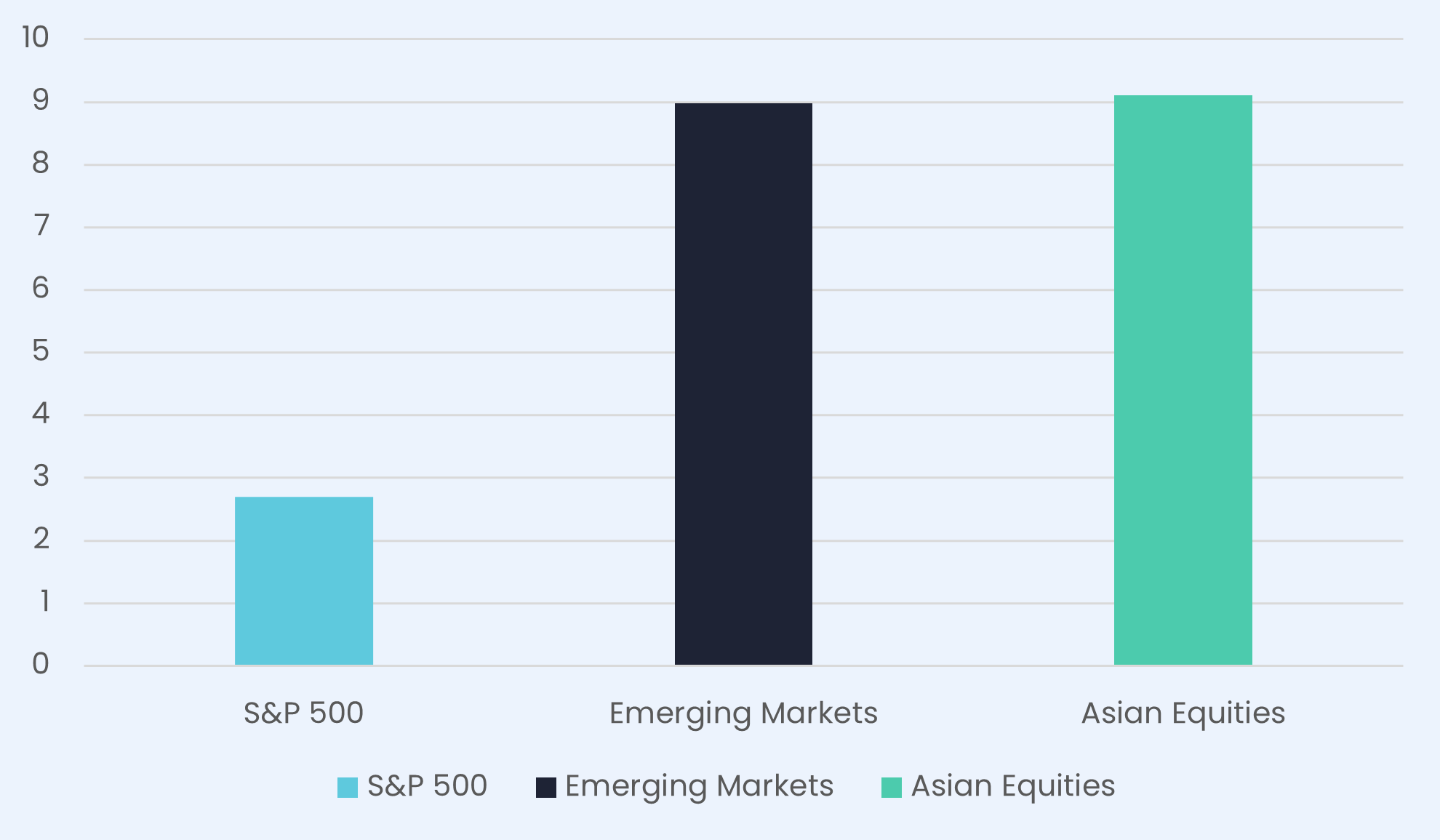

U.S. equities saw solid Q4 2025 performance, with the S&P 500 rising 2.7% and the Nasdaq climbing 4.9%, primarily driven by strength in the technology sector—especially AI-related mega-cap names—whose resilient earnings and outsized influence lifted overall market returns.

Emerging markets equities outperformed developed peers in Q4 2025, with the MSCI Emerging markets index posting gains of 8.96% versus 6% for global developed markets. This strength was driven by dollar weakness, easing U.S. rates, and robust growth across Asia—particularly in India, South Korea, China and Taiwan. Developed markets faced more muted returns amid slower economic momentum and lingering geopolitical uncertainty.

In Europe, the MSCI Europe ex UK Index rose 5.9%, fuelled by strong performance particularly in Germany and France where financials and industrials rallied on signs of a manufacturing rebound and ECB signals of policy support. Scandinavian countries also outperformed supported by cyclical strength, while Southern Europe lagged slightly due to slower economic activity and ongoing political headwinds.

Global Equity Markets

UK equities posted modest gains in Q4 2025, with the FTSE 100 up 0.8% and the FTSE All-Share rising 3.6%, supported by strength in energy and financials amid stable commodity prices and expectations of Bank of England rate cuts. Defensive sectors such as healthcare also contributed, while consumer discretionary and real estate lagged due to weak domestic growth signals and fiscal concerns. Overall, large-cap resilience contrasted with broader market momentum, reflecting cautious investor sentiment.

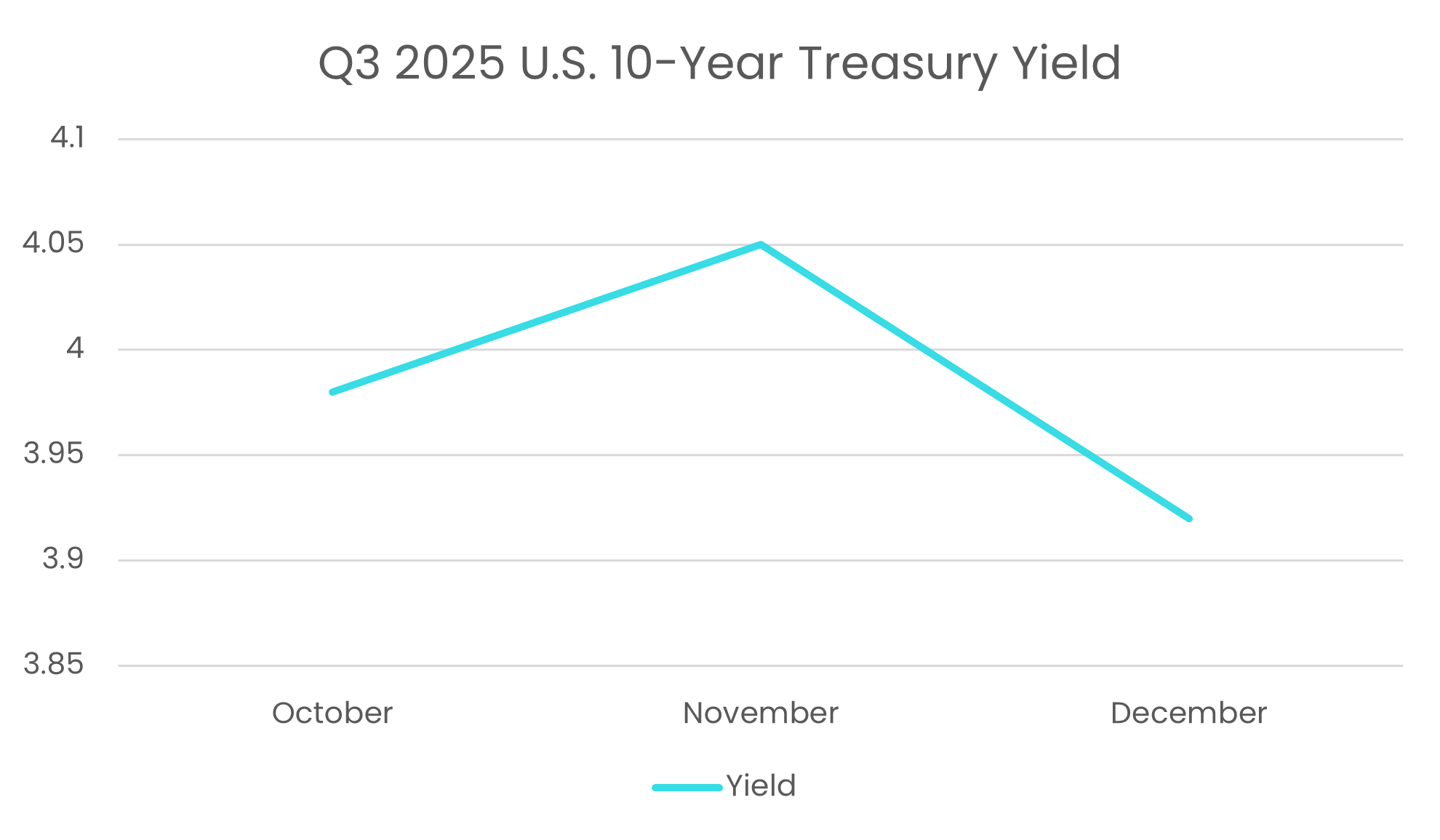

The Federal Reserve cut its benchmark rate by 25 bps to 3.50%–3.75% in December, responding to a softening labour market and tariff-driven inflation risks. The 10-year U.S. Treasury yield eased to 3.92% as markets priced in further policy easing. Emerging market and corporate debt rallied on improved risk sentiment and dollar weakness, with local-currency bonds, sovereign spreads, and high-grade corporates tightening amid dovish Fed signals.

Fixed income and Monetary policy:

Commodities:

Investor demand for safe-haven assets intensified during the quarter. Gold ended Q4 at approximately $4,300 per ounce, rising about 11% from Q3, while silver closed near $79 per ounce, surging roughly 70% over the same period, reflecting heightened market uncertainty and risk aversion. These moves underscore a broader sentiment of caution among investors that emerged in Q3 and intensified in Q4, driven by escalating geopolitical tensions, persistent macroeconomic instability, and policy developments such as China’s updated silver trading framework, which raised expectations of tighter supply and contributed to upward price pressure in Europe and Western markets.

Q4 2025 IP MPS Performance and fund changes

Accumulation Range

During this period, we introduced the Artemis SmartGARP Emerging Markets Fund to the Balanced, Moderately Adventurous, and Adventurous Accumulation portfolios. This broadened and diversified emerging markets exposure within these models. We also reduced exposure to the L&G S&P 500 Equal Weight Index in the higher risk models preferring direct exposure to the US market through the Fidelity Index US fund.

Income Range

Our Income range continued to deliver competitive performance supported by favourable income-generating market conditions. Given the returns and the portfolios’ alignment with their stated risk and yield objectives, no adjustments were deemed necessary.

Passive Range

Within our Passive range, we reduced the allocation to the Aviva Multi‑Asset Core funds and introduced BlackRock MyMap funds to the Moderately Cautious and Balanced portfolios, and also added the L&G Multi‑Index 7 to the Moderately Adventurous model due to better risk adjusted returns. We. As per the Accumulation range changes, we trimmed our holding in the L&G S&P 500 Equal Weight Index in higher risk models and reinstated the Fidelity Index US fund to help smooth US equity returns. Gilt exposure was marginally reduced across these portfolios, with the proceeds reallocated to higher‑performing corporate bonds.

Martin Nelmes

Investment Director and Chairman of the Network Investment Committee

This document is aimed at Investment Professionals only and should not be relied upon by Private Investors. Our comments and opinion are intended as general information only and do not constitute advice or recommendation. Information is sourced directly from fund managers and websites. Therefore, this information is as current as is available at the time of production.

On-Line Partnership Group Limited (reg. no. 03936920) and its subsidiaries, The On-Line Partnership Limited (reg. no. 03926063) and the Whitechurch Network Limited (reg. no. 03663042) trade collectively as In Partnership. All three companies are registered in England and Wales. The On-Line Partnership Limited and the Whitechurch Network Limited are authorised and regulated by the Financial Conduct Authority. Registered Office: 50-56 North Street, Horsham, West Sussex, RH12 1RD.